Last Thursday, August 7, the new tariffs imposed by United States President Donald Trump went into effect. In the case of Costa Rica, the tariff was set at 15%, one of the highest in Central America.

As explained by Costa Rica President Rodrigo Chaves, Costa Rica is among the countries that sell more to the United States than they buy from. In other words, there is a trade surplus. This is what would be motivating Trump’s decision, according to Chaves.

The balance in Costa Rica’s favor reached almost US$2 billion in 2024, and this year it so far exceeds US$1 billion.

However, the Costa Rican government maintains that the negotiations are not over. After being surprised by the White House’s announcement last week, raising the tariff for Costa Rica from 10% to 15%, the government of Rodrigo Chaves has insisted that there is still room to change this outcome.

The majority of Costa Rica’s exports are now subject to this tariff. Last year alone, 47% of all exports leaving Costa Rica were destined for the United States.

In 2024, the top products exported to the United States were:

- Medical devices: 22.9%

- Pineapple: 7.7%

- Banana: 4.3%

- Tires:1.6%

- Gold Coffee: 1.4%

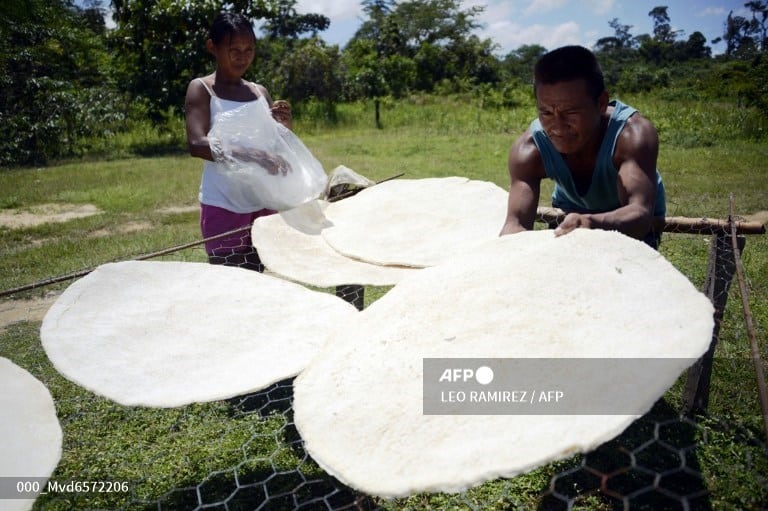

- Yuca (Cassava): 1.0%

Who will pay the 15%?

This tax is calculated on the value of the merchandise. Additionally, it is paid by U.S. importers to their government. Thus, if a U.S. importer imports a product worth US$100 from Costa Rica into their country, they will have to pay a tariff of US$15.

However, importers could assume part of this payment (out of pocket). They could also raise the price of the products they sell in the United States and thereby finance the additional payment they will have to make to the government.

“The U.S. consumer will be the main loser. To a lesser extent, the local producer, the importer, and the U.S. distributor will suffer,” economist Alberto Franco explained.

Roxana Morales, economist and coordinator of the Economic and Social Observatory (OES) at the UNA School of Economics, commented that Costa Rican producers (and those from around the world) could also assume part of this cost. To compete, they could lower the price of their products, which would give importers more leeway to continue buying from them or view Costa Rican products as an option.

“A portion (of Costa Rican exports) could be reduced. That is, Americans could reduce their purchases from our country or prefer to buy from other companies in other countries with lower tariffs,” Morales explained.

“All of this won’t happen immediately. It will be a process that will unfold over time and according to the contracts and agreements between the two countries,” she added.

Additional impacts from tariffs?

Franco believes this tariff is expected to limit the dynamism of exports from Costa Rica. It will also affect Foreign Direct Investment (FDI) and likely private consumption.

“The tariff will have a (negative) impact on the productive sector, whose activity is primarily oriented toward the US market,” he added.

“The United States is a country where consumption is very price-sensitive. That is, when prices increase, people tend to look for substitutes for the things they buy or change their consumption more noticeably,” Laura López, general manager of the Foreign Trade Promotion Agency (Procomer)

“It’s not just an increase for Costa Rica (products). The U.S. consumer will feel it across their entire basket,” the official added.

Source link

Rico