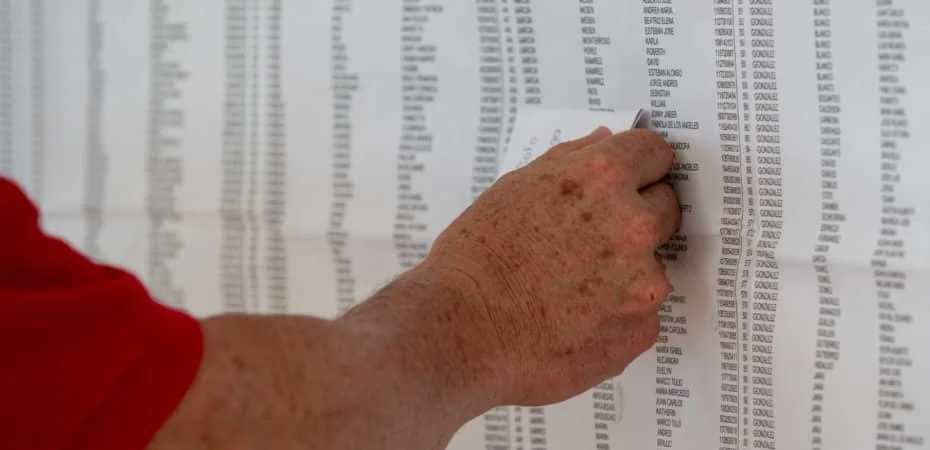

QCOSTARICA – The collection of the 2024 Marchamo begins today, Friday, November 3, announced the Instituto Nacional de Seguros (INS), on its website on Thursday. The

The Marchamo collection traditionally begins on November 1. This year the delay was the readjustment required by the insurance superintendency for INS to adjust its rates for the Seguro Obligatorio Automotor (SOA) – obligatory insurance – and eliminate the surcharge for the ‘Digital Marchamo’ that will apply in 2025.

– Advertisement –

For 2024, the reduction to the SOA is a whopping ¢46 colones (US$0.08) over last year.

“Our technical teams initiated all the operational work that allow us the adjustments considered in the laws recently approved by the Legislative Assembly,” said Sidney Viales Fallas, head of the INS.

The amount of marching 2024 may be consulted on the INS website starting at 6:00 am this morning.

The Marchamo is made up of a number of items: Vehicle property tax (67.3%), obligatory insurance (19.9%)and contributions to the Consejo de Seguridad Vial (Cosevi) 5.5%, among other items and of couse the 13% IVA (value added tax) on the taxes and services (insurance), which is what the Marchamo is.

Reduction for 2024

One of the items taken into account to calculate the 2024 Marchamo is the property tax, as it will fall from 10% to 50% for all vehicles, as approved in the law, with respect to 2023.

– Advertisement –

Read more: 2024 Marchamo reduction gets official approval

For example, a 2011 vehicle whose fiscal value is ¢2,970,000 that paid ¢80,000 colones for 2023, will pay ¢39,000 for 2024; a vehicle with a fiscal value of ¢9.4 million, paid ¢409,000 for 2023, will pay ¢192,000 for 2024.

Again, the reduction only applies to the property tax and not the other items.

SOA for Automobiles

As mentioned previously there will be a reduction in the obligatory insurance on private vehicles, but it is insignificant, only ¢46 colones.

– Advertisement –

However, premiums for motorcycles (3.68%), taxis (1.96%), buses (2.78%) and special equipment will increase. This is due to the increase in the accident rate of these vehicular groups.

For example, all private vehicles (particular) – the blue license plates (green for electrics) – will pay ¢25,077, irrespective of their make, model, year, and fiscal value.

Light commercial vehicles (carga liviana – CL) will pay ¢17,686 for the SOA; heavy commercial (carga pesada – C) ¢26,931, motorcycles (motos – M) ¢86,427, buses ¢70,580, and taxis ¢69,452 colones.

The benefits of having the SOA provided by the INS, related to a traffic accident, are: Surgical, hospitable, pharmaceutical and rehabilitation medical assistance; Prosthesis and medical devices that are required to correct functional deficiencies; Monetary benefits that correspond to compensation for disability, temporary or permanent, or Due to death; Payments of transfer, lodging and food when the injured, on the occasion of the supply of medical or rehabilitation benefits, must be transferred to a different place to that of its habitual residence, and the INS cannot provide the service; Costs incurred for funeral and transfer of the body in the even of death; coverage of up to ¢6 million for all vehicular classes.

Additional insurance can be purchased from the INS or private carrier.

Where and when to pay

The Marchamo is due payable by December 31, after which, drivers behind the wheel of a vehicle circulating with the unpaid Marchamo faces a monetary fine and/or confiscation of the license plate and/or the vehicle itself. No grace period exists.

The Marchamo can be paid online at the INS portal, at any financial institution and at any authorized INS office.

– Advertisement –

Source link

Rico